Accessing

Superannuation

Early

Accessing Superannuation early is now possible for many Australians because of the COVID19 pandemic. Normally accessing super early is restricted to those in financial distress, but now there are thousands of people who need access to their cash and the rules have been temporarily changed. People with Superannuation accounts can now withdraw up to $20,000 over the next two financial years. Depending on your circumstances, this money maybe vital for your food and shelter to assist you through to the end of this lockdown and the subsequent economic reverberations to come. For some who have no cash reserves (emergency fund) and an expensive lifestyle to maintain, revisiting your outgoing spend would be worthwhile.

The Case for Withdrawing Super

Drawing your super early is really down to your personal circumstances, whether you’re in a dire financial situation, see an opportunity to go on a spending spree or you want to claw back full ownership of your hard earned money.

The Case for Not Withdrawing Super

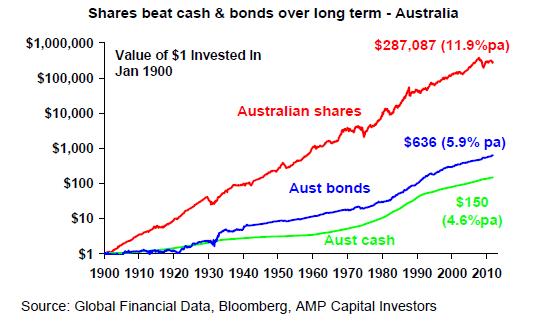

How much will I be financially worst off in the future? Being a superannuation account holder effectively means you’re an investor. Superannuation is legislatively forced upon workers, however that comes with very little education on investing. Investing in it’s most simplest and conservative form, is creating an investment strategy and sticking to it throughout the accumulation phase. Investment assets are priced everyday, which is why your account balance is constantly changing. However if you look at your account balance over several years, the trajectory is generally up. This comes from the combination of contributions and growth in asset prices. At the time of writing, the citizens of the world are locked down and assets are being revalued from a very gloomy perspective, hence the dramatic fall in value of superannuation assets. What investment history tells us, is that humanity encounters problems, solves the issue and grows until the next problem.

Reckoning the Future

If you have a long term investment horizon, you can see that selling during a downturn will affect your investment returns. This is because –

You’re selling assets for a price that is lower than recent valuations.

- You’re most likely going to buy those same assets again at a much higher price.

- Lost compound interest.

Example: Withdrawing $20k five years into your savings plan

| No Withdrawal | Withdraw $20k in Year 5 |

Starting Amount | $0 | $0 |

Annual Contribution | $10,000 | $10,000 |

Interest Rate | 8% | 8% |

Years | 30 | 30 |

Total Contributed | $300,000.00 | 300,000.00 |

Total Interest | $832,832.11 | $670,924.30 |

Total | $1,132,832.11 | $953,388.30 |

Savings Decrease |

| $179,443.81 |

Compounded Annually

Cheers,

SFF